Boat Insurance provides coverage in an event of damage or loss to your boat. Most types of watercraft are covered under this policy, however; do check with your local Florida licensed insurance agency if your specific watercraft is covered or not. Typically, personal watercraft, kayaks or canoes are not covered in boat insurance policies.

A boat insurance policy should provide for property damage and bodily injury liability. This covers you in the event of damage caused by you to someone else, their boat or property. Collision damage covers for repair or replacement of your boat and comprehensively provides for compensation for non-collision related incidents such theft of vandalism. Additional coverage options such as on the spot assistance, oil spills or medical payments can be also be added to the primary boat insurance policy. Most policies come with a deductible, which is the amount you must pay out of pocket before the insurance policy kicks in.

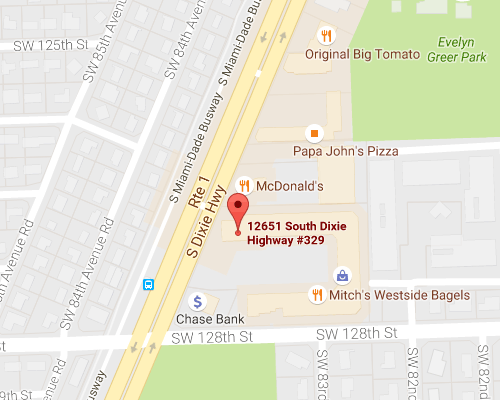

Most marinas require you to have boat insurance for you to use their docks. Similarly, if you are financing your boat, the lender will require you to have boat insurance. The passengers of your boat are also covered under the liability portion of the insurance policy. The type of boat you have, your age, location, gender, previous history and more will all contribute to the boat insurance premium rate you are offered. An experienced insurance agency such as Hamilton Fox & Company Inc. serving Pinecrest, FL can guide you with boat insurance. Their agents are experienced in all the requirements and guidelines for boat insurance in the state of Florida. The best way to get in touch is to give them a call. The phone number for the Pinecrest, FL office for Hamilton Fox & Company Inc. is available on their website. The agent will be glad to assist you.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions