When you think about the most valuable asset for your business, your employees have to top your list. You may have the best products or assets, but your efforts are naught if your workforce isn’t up to scratch. Zero. Nil. Given that your employees are an important cog of your business, you shouldn’t fail to protect them. One of the surest ways to safeguard your workers is by investing in worker’s comp insurance from Hamilton Fox & Company Inc. in Pinecrest, FL. But how does worker’s comp insurance work? Let’s dive in.

What is worker’s comp insurance, and how does it work?

This insurance covers employees when injuries and illnesses occur because of their jobs. For instance, this coverage will come to your rescue if you suffer from carpal tunnel syndrome because you constantly use your wrists when typing. Similarly, this insurance coverage will cover medical costs for obvious injuries like back pain, fractures, and sprains from falls, heavy lifting, and other injuries in the workplace.

Worker’s comp insurance is mandatory in most states, and usually, it’s the employer’s expense — the employee doesn’t pay anything. Once an employee files a claim for worker’s comp insurance, the employer has to ascertain that the injury or illness is work-related.

What does worker’s comp insurance cover?

This insurance is a worthwhile investment because it cushions your business in several instances. Worker’s comp insurance covers your employees against the following:

- Medical expenses, including medication, hospitalization, ongoing care, and emergency surgery

- Partial loss of wages

- Disability benefits

- Death benefits

However, you have to note that worker’s comp insurance won’t cover commuting injuries, substance abuse, and workplace fights. So, enlighten your employees on the same to ensure they don’t become frustrated when filing claims.

Safeguard your employees today!

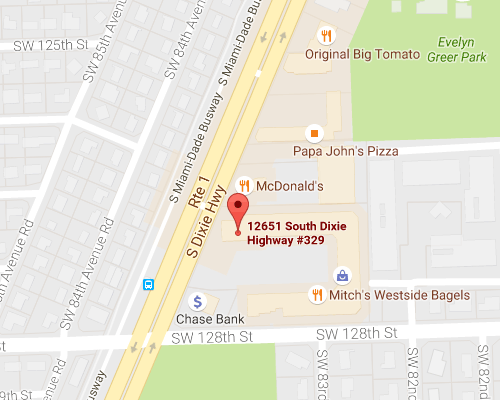

Want to purchase worker’s comp insurance in Pinecrest, FL? Please talk to Hamilton Fox & Company Inc. for a reliable policy.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions