Daycares are an important part of many family’s lives and provide high-quality care at a reasonable price. If you run a daycare in Pinecrest, FL and need help finding a policy for your company, let us at Hamilton Fox & Company Inc. explain how this type of coverage helps.

How Insurance Protects Your Clients and You

Daycare insurance is designed to not only protect your financial status but to ensure that your clients are safe and healthy while visiting. This type of commercial insurance is designed to provide payments for injuries and damage caused to your clients or your building.

This coverage protects your clients by paying them money instead of forcing them to pursue a lawsuit. By contrast, it protects you by keeping you from losing money in a lawsuit. Just as importantly, it helps to repair damage caused to your building by improper activities and actions.

Coverage Varies Based on Your Location

One interesting fact that could affect your daycare insurance is where your facility is located. For example, if you run a daycare center out of your home, your policy will vary because your home will be classified as a business and treated as such by your policy.

Conversely, operating a daycare center in an office building – or another commercial center – typically requires you to get a slightly different type of policy. The exact differences are mostly minor and mostly affect what items that you can ensure on your daycare property.

Find a Policy That You Like

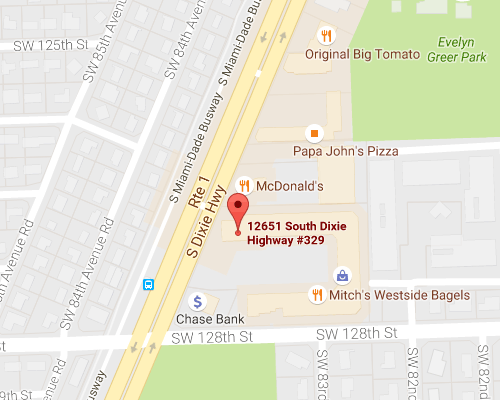

So if you run a daycare center in Pinecrest, FL and want to insure yourself and protect your clients, please contact us at Hamilton Fox & Company Inc. We have many options for daycare centers like yours and will work to provide you with the best possible policy.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions