Boat insurance covers damages to your boat/watercraft, including your personal belongings. It also protects you against any liability claims. Whether you use your boat on a regular basis or occasionally, you are still exposed to the same risks. Pinecrest, FL is home to several water activities and has excellent weather, it’s only natural that you’ll want to enjoy your day with different boating activities.

Insuring your boat with Hamilton Fox & Company Inc. is the best way to protect your investment and have fun days, worry-free.

As much as boat insurance isn’t mandatory in Florida, it’s still important to protect your investment from unforeseen circumstances, not to mention that lenders may require it before financing your boat. Risks covered by boat insurance include:

Collision damages: This covers the cost of damages to your boat in case your boat hits or is hit by another watercraft or object.

Comprehensive damages: This covers damages that are non-collision related. They include fire, theft, vandalism, and damages due to weather events. It’s important to review your policy and understand exactly what is covered.

Liability claims: There is always a possibility of you causing an accident that would result in someone’s injury or property damage. This part of your policy covers your legal expenses and any compensation costs.

Uninsured/underinsured boaters: Since boat insurance isn’t mandatory, most boaters don’t have any insurance. So, what happens when an uninsured/underinsured boater hits your boat? This part of your policy covers damages to your boat and bodily injuries in such scenarios, including hit-and-runs.

Other minor risks covered by boat insurance include oil spills, road assistance, personal property damage, and fishing equipment damages.

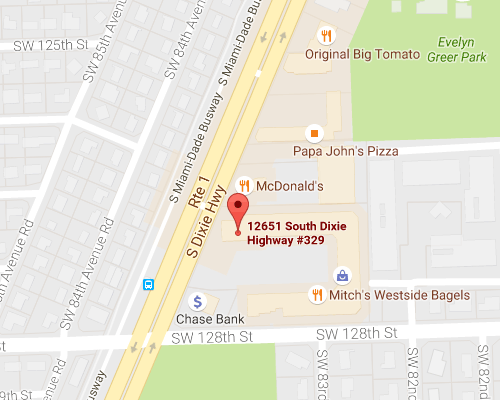

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions