Homeownership is challenging in and of itself, and understanding all the terminology involved in buying a home is even more complex at times. With that in mind, our team at Hamilton Fox & Company Inc. in Pinecrest, FL, wants to clarify how to protect your home with mortgage or homeowner’s insurance. We’ll discuss how these two policies differ and what they cover.

What Mortgage Insurance Covers

Lenders can foreclose on your property if you have a mortgage and default on payments. Mortgage insurance is designed to reimburse those lenders for some of the balance, which reduces your debt. However, you won’t financially benefit at all beyond that. Coverage terms vary but usually are for the length of the loan. When buying a new home, you’ll likely be mandated by the lender to have mortgage insurance.

Coverage Offered By a Homeowners Insurance Policy

Homeowner’s insurance can be paired with mortgage policies or carried by those who have paid off their home. This is a much more comprehensive range of coverage with greater protection that can be useful in various common situations homeowners may face, including:

- Dwelling—Protects the home’s structure as a whole, including floors, walls, ceilings, roofing, etc.

- Personal Property—Provides compensation for the estimated value of your possessions should they get stolen or damaged.

- Liability Coverage—Helps pay for settlements and legal expenses if someone files a lawsuit because of an injury they suffered on your property.

- Additional Living Expenses—Typically covers expenses for food and housing should your house be uninhabitable due to damage from a covered incident.

Ready for Florida Home Insurance?

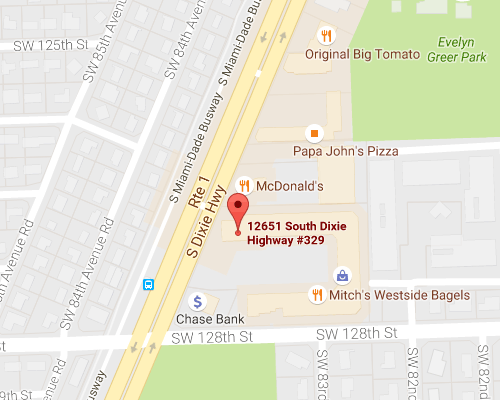

If you have mortgage or homeowners insurance questions, contact Hamilton Fox & Company Inc. in Pinecrest, FL. We’ll answer those questions and provide you with a quote for the policy you need.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions