Navigating the return-to-work process after an injury can be challenging for both employers and employees. At Hamilton Fox & Company Inc., serving the greater region in and around Pinecrest, FL, we believe that effective strategies are vital to supporting your team’s recovery and reintegration.

Understanding the Process

The return-to-work process starts with open communication. Maintaining a dialogue with the injured employee is essential to understanding their needs and limitations. This helps create a tailored plan that addresses their specific situation, ensuring a smoother transition back to work.

Creating a Supportive Environment

A supportive work environment is crucial for successful reintegration. Consider modifying tasks or adjusting schedules to accommodate the recovering employee. This not only aids their recovery but also demonstrates your commitment to their well-being. Encourage coworkers to offer support and understanding, fostering a positive atmosphere that benefits everyone involved.

Ongoing Assessment and Feedback

Assess the employee’s progress regularly and be open to making necessary adjustments to their duties. Encourage feedback from the returning employee to understand any challenges they might be facing. This proactive approach helps identify areas for improvement and ensures that the return-to-work plan remains effective.

Are You In Need of Workers’ Compensation Insurance?

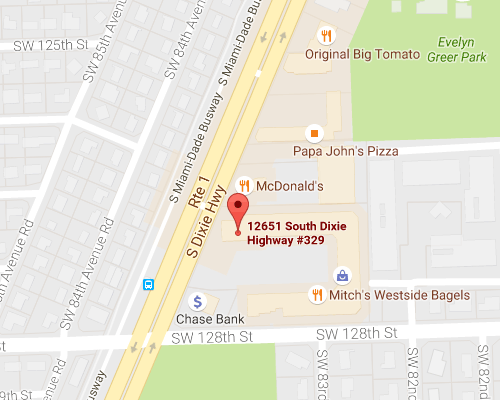

At Hamilton Fox & Company Inc., serving the community of Pinecrest, FL, we’re dedicated to helping businesses implement successful return-to-work strategies. Our expertise in workers’ compensation insurance allows us to provide valuable insights and support tailored to your company’s needs. Contact us today to learn how we can assist you in creating a safe and supportive return-to-work program for your employees. Let’s work together to ensure a seamless transition back to productivity.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions