Florida sees its share of natural disasters. Hurricanes, lightning, and other events can cause damage to your home. Some issues are so severe you can’t address them on your own. So, does your come insurance cover these home repairs?

What Home Insurance Handles

According to the insurance experts at Hamilton Fox & Company Inc., your home insurance policy covers damages connected to fire, theft, wind, lightning, and some hurricane damage. The costs it handles depend on two factors. One is your initial selections and deductible limits. The second is what the insurance adjuster determines to be the repair costs.

What Home Insurance Doesn’t Handle

Home insurance policies for Florida homes do not cover repairs for storm-related floods. You must have a flood policy to handle this natural disaster. Mortgage companies don’t approve financing for flood-prone homes without a policy.

On top of this, purchasing hurricane insurance is a good idea if you live near the ocean or a large water tributary. By doing this, you blanket your property to minimize additional costs.

What You Need To Cover

Whether it’s a home, flood, or hurricane policy, make sure you carry significant coverage to handle the following:

- Your dwelling

- Detached units, like a shed, separate garage, or guest bungalow

- Personal property such as furniture, electronics, and jewelry

- Living expenses to pay for temporary housing during repairs

You have much to consider when choosing the right policies for you and your family. In most cases, you don’t want to do it by yourself. In the end, it’s better to speak with subject matter experts in the insurance field.

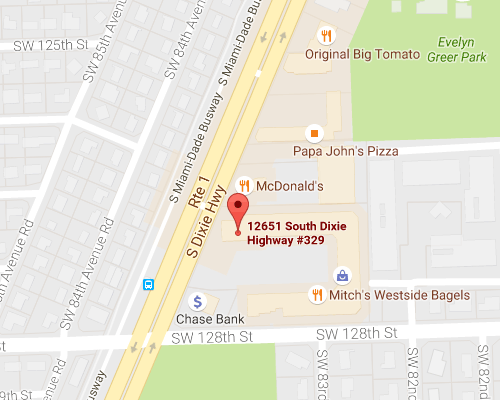

If you’re ready to purchase additional policies, or want to upgrade existing ones, contact representatives at Hamilton Fox & Company for assistance.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions