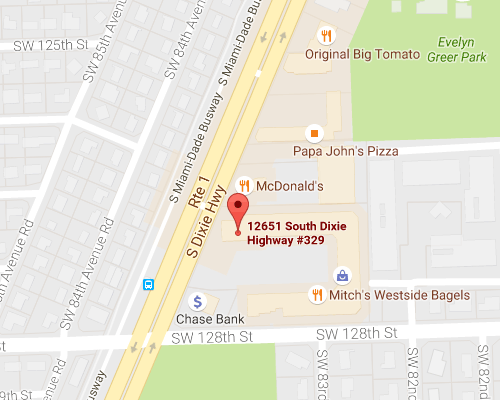

Most home insurance claims fall into two categories: property damage or personal injury. Property damage claims are common, and they can be anything from a hailstorm to a broken water heater. Personal injury claims are less common but can be serious and costly. They might include an injury from a fall on slippery steps or something as simple as a sprained ankle from a tripping hazard. For help, consult Hamilton Fox & Company Inc. in Pinecrest, FL.

More About the Common Home Claims

Flooding and lightning strikes are the most common home insurance claims, accounting for about 40 percent of all claims. Water infiltration and freezing pipes are the most common causes of flooding. Falling trees and outdoor property damage cause about one-third of all claims.

Accidental damage by a guest or family member is the most common cause of falling tree claims. Pets cause everything from allergic reactions to property damage. Children’s unintentional injuries, such as fires, can also become part of the common claims.

About 20% of claims are due to fire, and 20% are theft or vandalism claims. The remaining claims are split between various causes, such as falling objects, earthquakes, or contractor errors. How do we avoid these claims? Most claims can be avoided by following best practices around your home, especially during high-risk weather events.

Home insurance policies usually have a clause stating that you are not covered if you are negligent in maintaining or using your property. Tying up loose ends, like unplugging your holiday lights when you’re not using them, can help prevent falling objects from damaging your home or being claimed on your insurance.

Bottomline

Property damage, such as a fire or water damage from a pipe burst, is the most common type of claim. Ensure you find a policy that fits your needs, and shopping around for a policy is an excellent way to start. Property insurance claims can range from a cracked foundation to a hailstorm that wreaks havoc on your home. The most common property insurance claims can be prevented with upkeep. You also want to be sure you’re filing your claims correctly. For any questions in Pinecrest, FL, contact Hamilton Fox & Company Inc.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions