The farming and agriculture industry continues to be extremely important as it helps to ensure that people all over the world are able to gain access to healthy food. At the same time, those that own farms in the Pinecrest, FL area also own large businesses that could be quite valuable. If you are in the agriculture industry, it is important to protect your farm with proper insurance. There are several benefits that come when you get a full farm insurance policy.

Liability Protection

If you are an owner of a farm, you are going to be taking on a lot of different liability risks. This could include risks that someone could be injured while they are on your farm or if a product you sell causes an injury or illness to another party. Since the damages associated with this risk could be serious, you will want to make sure that you are properly covered at all times with a farm insurance policy.

Coverage for Assets

Another reason that you should get farm insurance is that it will give you coverage for your farm’s assets. A farm owner is going to invest a lot in different assets that are needed to build and operate the business. To ensure that these assets are protected, you will need to get farm insurance as it will give you a certain level of coverage for your business assets.

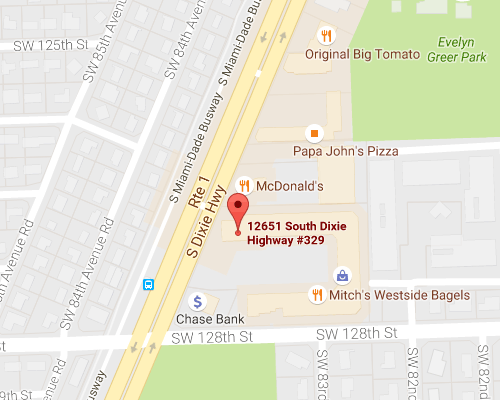

There are a lot of reasons that you should get a farm insurance policy. When you are looking for this insurance, you should reach out to the team at Hamilton Fox & Company Inc. The team at Hamilton Fox & Company Inc. can help farm owners all over the Pinecrest, FL area get into insurance policies that protect themselves and their investments.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions